Casino Title 31 Free Testing

PartyCasino: Get 120 free spins on Starburst Make a deposit of £10 or more as a new PartyCasino player to receive 120 free spins on Starburst, thanks Casino Title 31 Free Testing to an exclusive bonus! Other Related Title 31 FAQs. FAQs regarding Non-Casino Cash Transactions Over $10,000 - Form 8300 Insights into when non-casino entities are subject to Title 31, Form 8300, and the reporting and recordkeeping requirements for them. Glossary of Terms Insights into the words and phrases used in the frequently asked questions.

It’s no secret that money laundering is a serious offense—and the IRS has thousands of cases to prove it. But what should your organization do about it?

To prevent criminals from using financial institutions to facilitate money laundering and terrorist financing activities, the IRS implemented the Bank Secrecy Act (BSA), also known as Title 31. This allows the Secretary of the Treasury to impose precautionary regulations on financial institutions to help prevent financial crime.

U.S. casinos that generate more than $1 million in gross annual gaming revenues are classified as financial institutions and subject to Title 31 requirements. All Title 31 casinos are required by law to have an effective anti-money laundering (AML) program and comply with federally mandated reporting expectations.

Implementing an AML Program

If your institution is subject to Title 31, you need a customized AML program. The IRS doesn’t issue standard plans for adoption, so each casino must develop its own program based on risks associated with its specific products and services. If your tribe has multiple casinos, each casino needs its own customized program. If you’re not sure if you fall under Title 31 guidelines, reach out to your BKD trusted advisor or reference IRS guidance on 31 CFR Chapter X.

According to the IRS, you should include these items in your AML program:

- Internal controls policies and procedures to ensure Title 31 compliance

- Casino employee training

- Independent compliance testing

- A compliance officer responsible for BSA compliance and the AML program

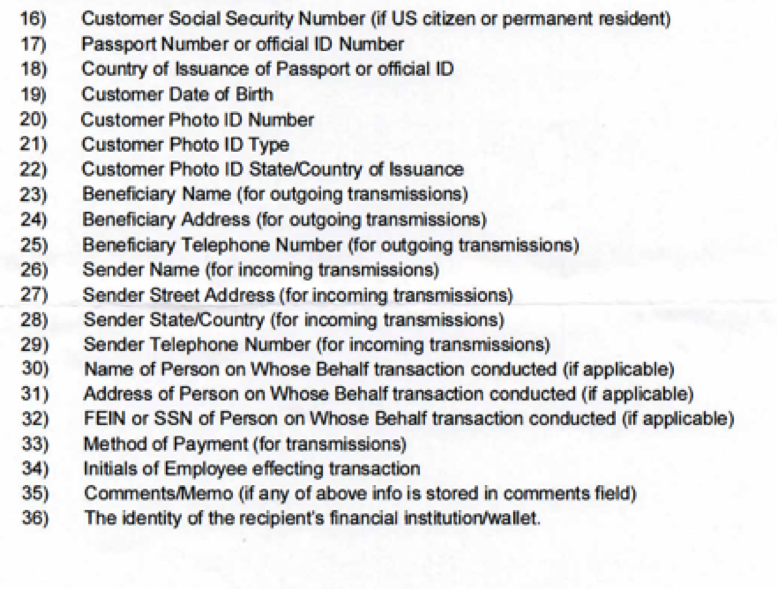

- Procedures for using all available information to determine and confirm a person’s identity, e.g., Social Security number, driver’s license, etc.

- Procedures for using all available information to determine suspicious activity

- Procedures for using technology to aid in assuring compliance (for casinos using computerized systems)

Reporting Requirements

Currency Transaction Report (CTR)

All financial institutions must file a CTR on any cash transactions exceeding $10,000. This allows the IRS to track high-volume cash transactions and prevent money laundering.

Types of transactions that require CTR (if exceeding $10,000) include:

- The purchase or redemption of chips, plaques and tokens

- Front money withdrawals and deposits

- Safekeeping withdrawals and deposits

- Payment or advances on any form of credit, including markers and counter checks

- Bets of currency

- Payments on bets (excluding video and slot terminal jackpots)

- Currency received by the casino via wire transfers

- Payments by the casino to a customer via wire transfers

- The purchase or cashing of checks or other negotiable instruments

- Currency exchanges, including exchanges for foreign currency

- Travel or entertainment reimbursements to customers

If a customer processes multiple cash transactions during a single day, it should be considered one transaction. If the individual transactions exceed $10,000 when combined, the casino must file a CTR. In addition, casinos should consider deposits and withdrawals separately and file all CTRs within 15 days of a transaction.

Suspicious Activity Report (SAR)

The BSA’s final requirement is the SAR. Title 31 states that a SAR should be used on all suspicious transactions exceeding $5,000. Criminals may attempt tactics like “structuring” (processing transactions in a pattern that avoids reporting) to cover up illegal activity. An example of structuring is strategically cashing in or out at less than $10,000 to avoid a CTR. All activities like this should be classified as suspicious and result in a SAR.

Source of Funds

Another important facet of your Title 31 program is identifying sources of funds to help detect and prevent money laundering. Although FinCEN hasn’t set forth specific guidelines, your BKD trusted advisor can help you structure a risk-based approach on conducting this type of due diligence.

Questions about complying with Title 31? Reach out to your BKD trusted advisor or use the Contact Us form below.

Title 31 Casino Test Answers

Florida is increasing testing capacity for COVID-19. Testing sites sponsored by the state of Florida and other entities are listed below and are free and open to the public.

Before you go:

- Does the site require an appointment?

- Does the site require a doctor’s order or other screening?

- Is today a federal holiday? If so, you may need to contact the testing site to confirm they are open.

- A diagnostic test tells you if you have a current infection. Tests are sent to an outside lab, and results are available within several days. These tests are considered very accurate when properly performed by a healthcare professional.

- A rapid test is another type of diagnostic test that makes results available in minutes if analyzed onsite at a testing center. These tests may be less accurate and miss some cases.

- An antigen test is a newer test that detects certain proteins that are part of the virus and can produce results in minutes. A positive antigen test result is considered very accurate, but there’s an increased chance of false negative results — meaning it’s possible to be infected with the virus but have negative antigen test results. Depending on the situation, the doctor may recommend a molecular test to confirm a negative antigen test result.

- An antibody test might tell you if you had a past infection. An antibody test might not show if you have a current infection because it can take 1–3 weeks after infection for your body to make antibodies. Having antibodies to the virus that causes COVID-19 might provide protection from getting infected with the virus again. If it does, it is unknown how much protection the antibodies might provide or how long this protection might last.

If you have questions about eligibility or access to testing, the COVID-19 Call Center is available 24/7 at 1 (866) 779-6121.

Many testing sites will be affected by the holidays. Please contact testing sites to confirm their hours of operation on 12/24, 12/25, and 1/1.

Test Results

The amount of time it takes to get your test results back varies. For information regarding your test, contact the testing facility that ordered or collected the test. See the Lab Patients Portal List for contact information (updated Feb. 23, 2021).

The Florida Department of Health and the COVID-19 Call Center cannot provide results, tell you exactly when or how you’ll get your results, or expedite results.

If you test positive for COVID-19, see guidance for what to do while you’re sick.

Exposed or tested positive? Look out for an official call from COVID-19 contact tracers.

If you or someone you have been in contact with tests positive for COVID-19, public health professionals will call to help you identify the time frame when you may have been contagious and recall your close contacts during that time.

Answer calls from (833) 917-2880, (833) 443-5364, (850) 583-2419 or county health departments to discuss potential exposure to COVID-19 with a contact tracer.

A contact tracer will NEVER:

Title 31 Casino Test

- ask for your Social Security number

- ask for private financial information

- ask for credit card information

- send you a link without proper authentication procedures

Free Casino Title 31 Training

Save the contact tracer numbers in your contacts so you never miss the call.